Proposed reforms to the National Policy Planning Framework and other changes to the planning system in response to a Ministry of Housing, Communities and Local Government consultation on this issue has gained support from Propertymark.

The professional body backs implementing changes to the planning system and is keen to see a system which represents the needs of residents and supports the building of necessary houses to keep pace with demand.

Propertymark believes it is vital the ministry initiate changes which will assist the UK government with their aim of constructing near 2 million new homes during this parliamentary term.

Lat month, Propertymark led a roundtable with members of their sales division to hear opinions about what is working with the planning system and what needs improving.

Responses highlighted a lack of local knowledge and consistency among local council planning officers and stated that planning requirements should be tailored to each area. Properties, therefore, need to be built for the specific needs of local neighbourhoods, as one area may need more housing for older residents than others, for example.

Members stressed that construction remains expensive, so councils would either have to build more affordable homes themselves or subsidise developers to meet precise demand.

To make matters more difficult, members said that there is a lack of incentives for landowners to sell to develop.

They also warned that without a long-term housing strategy from successive governments, there can be no way for politicians to ensure that there are housing options across all tenures to meet the needs of local communities on an individual basis.

There was also strong feeling that new homes should also be built on brownfield sites first, be more energy efficient, and not compromise any natural landscapes.

Commenting on members’ feedback, Rose Forman, policy and campaigns officer at Propertymark, said: “Focusing on planning reform is an important step for the UK government to deliver the magnitude of new homes it has promised. Propertymark consulted with our members who said there is a greater need for planning requirements to be more area specific, and for greater local knowledge and consistency in the decisions made by local authority planning officers.

“Our members want to see homes built for the demographics who will need them and in the precise locations for which there is demand. The type and cost of construction must be taken into consideration and the UK Government must have a long-term strategy which future-proofs our towns, villages and cities for generations to come. New homes must be energy efficient and built around robust supporting infrastructure, such as upgrades to road and public transport setups, as well as wide ranging health and education provision.”

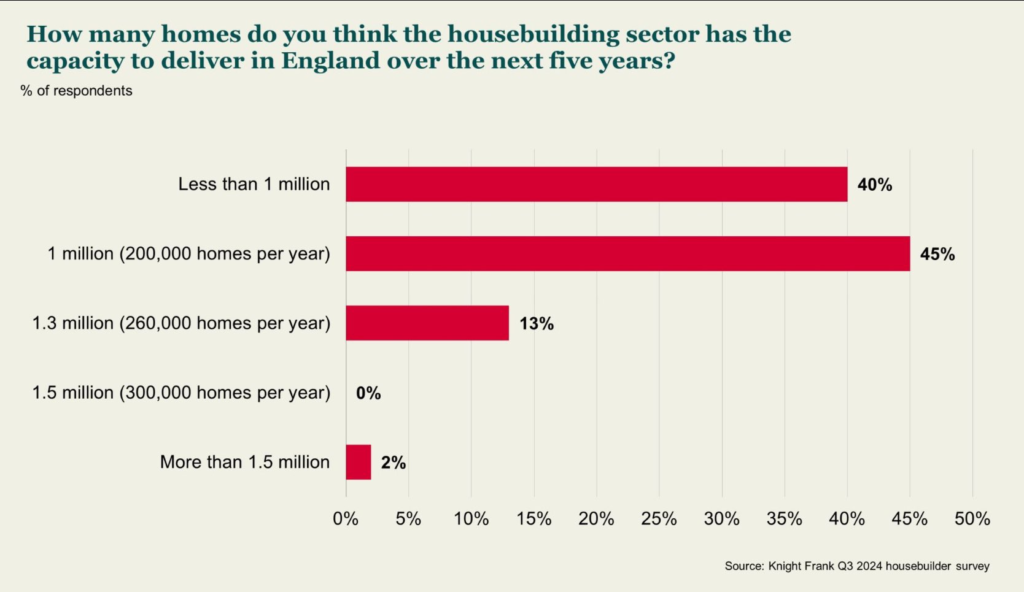

See below: Knight Frank graph from recent Telegraph story questioning Labour’s 1.5m housing target shows 0% believe they will and 2% of respondents believed they will exceed the target.

Original Post: https://propertyindustryeye.com