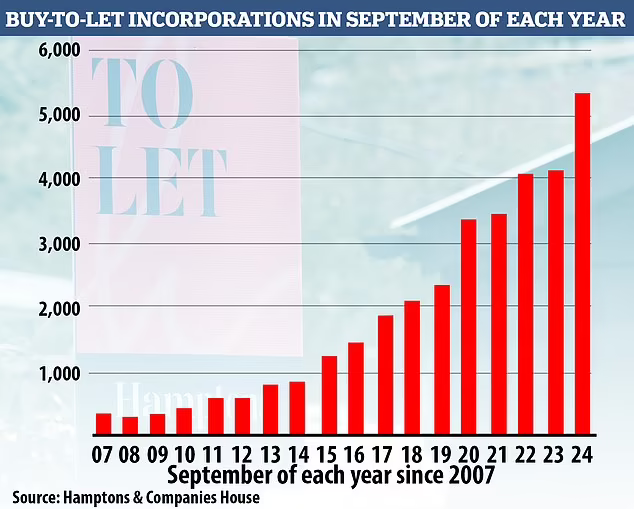

A record number of landlords have set up limited companies to purchase buy-to-let properties this year, in a bid to reduce tax on their investments.

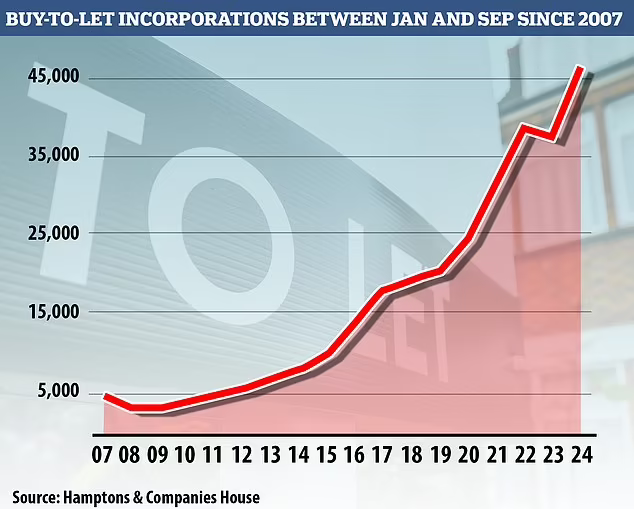

Between January and September this year, 46,449 buy-to-let companies were set up, a rise of 23 per cent on the same period last year.

That is according to analysis of Companies House data by the property firm Hamptons.

Holding property in a limited company, also known as ‘incorporating’, is an alternative to holding it in their own personal name, and the tax structure is different.

More limited companies have been set up by landlords so far this year than during the whole of 2021.

Hamptons estimates that by the end of the year, between 60,000 and 62,000 limited companies will have been set up, exceeding last year’s 50,004 total, or any previous year for that matter.

There are now a total of 382,007 companies of this type, holding almost 667,000 properties within them, in England and Wales.

This figure has increased 175 per cent from 242,249 a decade ago.

But despite most new purchases going into a limited company structure, only around 15 per cent of all existing rental homes owned by private landlords are held in such a way.

Why are landlords using limited companies?

The increase has been driven by the different ways buy-to-lets in companies and buy-to-lets in personal names are taxed.

Seven in 10 of new buy-to-let purchases in England and Wales are now made using a limited company, according to Hamptons, with the remaining three in 10 bought in personal names.

Prior to 2016, the limited company structure tended to be the preserve of larger landlords.

However, Hamptons says the growing tax advantages for higher-rate taxpayers have attracted the attention of smaller investors.

So far this year, 54 per cent of new purchases have been made by companies who are making their first, second or third purchase.

Owning within a limited company comes with various tax advantages, including the fact that corporation tax – payable in a company structure – is lower than income tax, which is payable for landlords who own properties in their own name.

This allows landlords to build up profit within the company, which they can use it to re-invest towards another property sooner than they might otherwise have done if owning in their own name.

Owning in a limited company also allows property investors to fully offset all of their mortgage interest against their rental income, before paying tax.

This differs from landlords who own property in their own name. They only receive tax relief based on 20 per cent of their mortgage interest payments.

There’s been a significant rise in the number of landlords moving homes they own in their personal name into a company to shelter from an increasingly aggressive tax environment

This is less generous for higher rate taxpayers, who previously received a 40 per cent tax relief on mortgage costs before a 2016 rule change.

A higher-rate taxpayer landlord with mortgage interest payments of £500 a month on a property rented out for £1,000 a month now pays tax on the full £1,000, with a 20 per cent rate on the £500 that is being used towards the mortgage.

A landlord who owns in a limited company with mortgage interest payments of £500 a month on a property rented out for £1,000 a month would only pay tax on £500 of that income.

Put simply, it means that whilst individual landlords are effectively taxed on turnover, company landlords are taxed purely on profit.

Nearly three-quarters of buy-to-let companies have been set up since the start of 2016, the point at which landlords who were higher-rate taxpayers stopped being able to fully offset their mortgage interest from their tax bill.

Existing investors are also shifting their buy-to-lets into limited companies to reduce their tax burden when they sell properties.

Given that properties sold by companies are not subject to capital gains tax, any increase will deepen this divide.

There are rumours that capital gains tax could be increased in the upcoming Budget, which may have contributed to the increase in landlords incorporating.

Aneisha Beveridge, head of research at Hamptons, said: ‘While landlord purchase numbers are well down on pre-pandemic levels, there’s been no sign of a slowdown in the number of companies being set up to put them in.

‘Most new purchases are now made in a company structure. However, there’s also been a significant rise in the number of landlords moving homes they own in their personal name into a company to shelter from an increasingly aggressive tax environment.

‘While the benefit of being able to offset mortgage payments before being taxed has been the primary driver for new incorporations over the last few years, more recently rumours of potential increases to capital gains tax or inheritance tax are further fuelling the rise.

‘An increase in personal tax rates will only widen the gap between the tax paid by landlords who own homes in their own name or a company name further.’

Drawbacks of limited companies for landlords

However, whether there is an advantage to be had or not depends on the landlord’s individual circumstances.

For example, lower-rate taxpayers, particularly if they don’t have a big mortgage on their buy-to-let, may be better off holding their buy-to-let in their personal name.

There are also the added mortgage costs to take into account when buying via a limited company, as lenders usually charge higher rates.

Finally there is an added layer of bureaucracy that comes with a company structure. Company accounts must be formally prepared and filed, records maintained, and directors appointed.

This creates more work for landlords choosing the limited company route, and an added cost if they use an accountant.

There is also likely to be added cost for those buying with a mortgage. This is because company mortgages tend to come with higher rates and fees on average.

Original Post: https://www.thisismoney.co.uk