- Limited company landlords can offset mortgage costs against their tax bill

- This isn’t possible for those owning properties in their own name

- But a company structure brings higher rates and costs – so is it really cheaper?

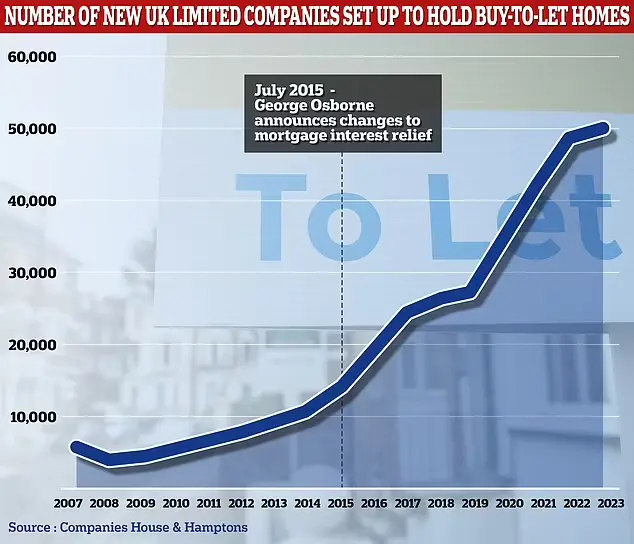

In recent years increasing numbers of buy-to-let investors have been buying properties via a limited company, rather than in their own personal name.

Last year alone, landlords set up a record 50,004 companies to hold buy-to-let properties, according to analysis by estate agents Hamptons.

There are a total of 615,077 buy-to-lets owned in company structures in the UK, an 82 per cent increase since the end of 2016.

One of the key reasons behind the surge in landlords buying via limited companies is that they can fully offset the interest they pay on mortgages against their tax bill. This tax perk is no longer afforded to people buying or owning buy-to-let property in their own name.

But there is a snag, in that mortgages for properties owned in a company structure are substantially more expensive. So what are landlords really saving?

Original post from : thisismoney.co.uk